How We Can Serve You

Retirement solutions that fit your specific needs and goals.

Our Services

From strategy to execution, we're here to help.

-

Whether you would like to set up a new retirement plan or make changes to an existing plan, we can help you evaluate your options.

-

Are you trying to recruit or retain key executives? A non-qualified deferred compensation plan can be an important element of a competitive total compensation package.

-

If administering your retirement programs is taking too much time and resources from you and your staff, we can relieve some or all of the burden by helping you streamline your administrative processes or providing you with total outsourcing services.

-

Are you concerned if your retirement plans are in full compliance with the law or operating within plan terms? Are you considering buying another company and need to know if there are any hidden problems with your target company’s plans? We can give you peace of mind and potentially save you thousands of dollars.

-

Are you considering finding a new service provider for your retirement, 401(k), 403(b) or 457 plan? Do you want to make sure you are getting fair and competitive pricing with your current providers? We can facilitate and guide you through a vendor search using our tried and proven process.

-

Are you being audited by the IRS or DOL? Have you discovered past problems with your retirement plans? We can guide you through the audit process and corrective measures

Your Bay Area Experts in Retirement Success

Our team can craft a custom retirement plan to help you meet your objectives.

From plan design and implementation, to compliance, administration, government reporting and filings, and ongoing plan support and consulting, we’re your experts in retirement services.

-

Traditional employer sponsored 401(k)

Safe Harbor 401(k)

Preparation of government filings

Complex plan options leveraging custom eligibility, vesting, contribution, and enrollment strategies.

-

Traditional Cash balance or Defined Benefit plans

Combos 401(k) and Cash Balance options to maximize tax deferred savings

Variable Annuity Plans

-

Allows employees to become partial owners of the company through stock allocations

-

Employer-funded retirement plans where contributions are discretionary

-

Tax-advantaged retirement savings plan for employees of public schools, non-profits, and certain religious organizations, allowing them to invest pre-tax income for retirement

-

Tax-deferred plans for government and certain nonprofit employees, allowing flexible contributions and penalty-free withdrawals upon separation from service.

-

Allows select employees to defer a portion of their income to a future date, offering tax advantages and flexible retirement savings beyond qualified plan limits.

-

Employer-funded, non-qualified plans that provide additional retirement benefits to key executives beyond standard retirement plan limits.

A Customized Approach

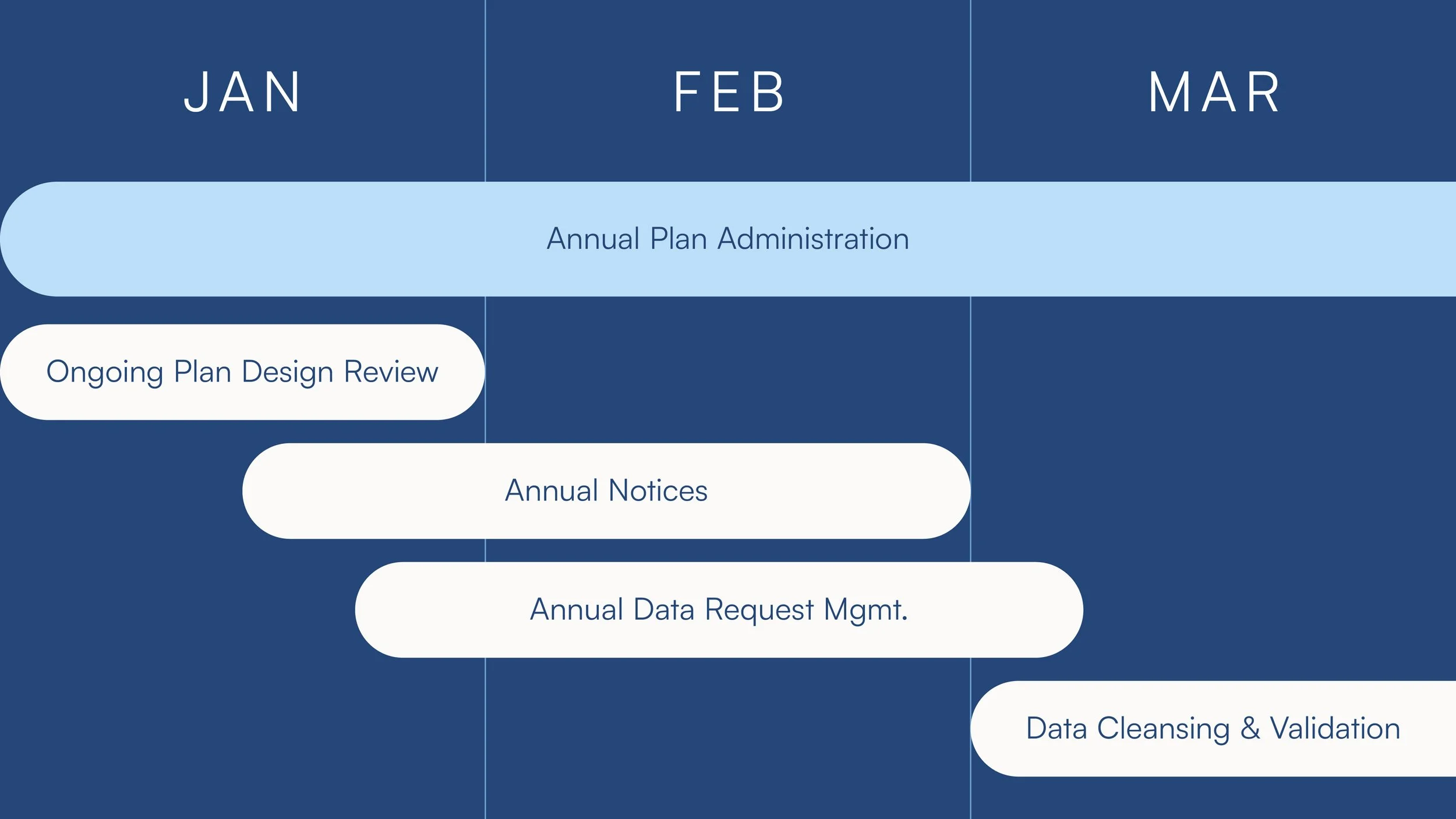

How we can serve you throughout the year:

Our team works with you throughout the year to ensure you minimize your tax liability, maximize your retirement savings, stay compliant, and effectively meet your goals.

Personal Design. Local Service. National Support.

Carlson Quinn’s local expertise, backed by the national resources of Strongpoint Partners, makes our team uniquely positioned to take on any challenge for any client.

Whether you’re a sole proprietor, such as a dentist, lawyer, or doctor, who needs a solution like a 401(k) or Cash Balance Plan, or an employer in the small business community, we can create a solution tailored for your business and your people, that ensures you’ll minimize your tax liability, maximize your retirement savings, attract and retain your employees, and reduces your risk through creditor protection.

10+

Retirement Consultants

200

Total Plans Administered

350+

Retirement Consultants

28K+

Total Plans Administered

$2.5B+

Assets Under Management

Carlson Quinn’s Local Expertise & Service

$44B+

Assets Under Management

Strongpoint Partners’ National Infrastructure

35+

Avg Design Specialist Tenure

9.5

Average Client Tenure

~1K

New Plan Designs/Year